Get the free nf4 form

Show details

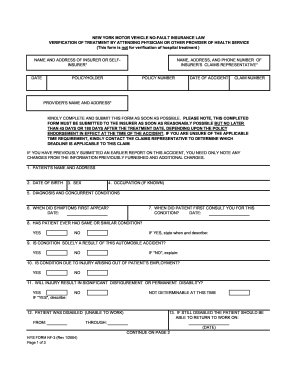

NEW YORK MOTOR VEHICLE NO-FAULT INSURANCE LAW VERIFICATION OF HOSPITAL TREATMENT NAME AND ADDRESS OF INSURER OR NAME AND ADDRESS OF INSURER OR SELFSELF-INSURER* INSURER* NAME, ADDRESS, AND PHONE NUMBER

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your nf4 form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your nf4 form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit nf4 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit nys form nf 4. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, dealing with documents is always straightforward. Try it right now!

How to fill out nf4 form

How to fill out nf4 form:

01

Start by collecting all the necessary information and documents required to fill out the nf4 form. This includes personal details, financial information, and any supporting documents related to the purpose of the form.

02

Read and understand the instructions provided with the nf4 form. Make sure you comprehend all the sections and requirements before proceeding.

03

Begin filling out the nf4 form by entering your personal information accurately. This may include your name, address, contact information, and any relevant identification numbers.

04

Move on to the financial section of the form where you may need to provide details regarding your income, assets, and liabilities. Fill in this section carefully, ensuring all information is correct and up to date.

05

If there are any additional sections, such as those related to specific requests or declarations, make sure to complete them accurately and honestly.

06

Double-check all the information you have provided on the nf4 form. Review each section thoroughly to ensure there are no errors or missing details.

07

Sign and date the form as required. Make sure your signature is legible and matches any other official documents you may be submitting alongside the nf4 form.

08

Finally, submit the filled-out nf4 form along with any required supporting documents to the designated authority or organization as instructed.

Who needs nf4 form:

01

Individuals who are eligible for certain tax deductions or credits may need to fill out the nf4 form. This could include individuals seeking to claim education expenses, medical deductions, or other similar benefits.

02

Business owners or self-employed individuals may also require the nf4 form to report their financial information for taxation purposes.

03

Additionally, individuals who are involved in legal proceedings or need to provide financial details for specific purposes may need to fill out the nf4 form as requested by the relevant authorities.

Fill form : Try Risk Free

People Also Ask about nf4

How does a non-fault claim work?

How much does a non-fault claim affect my insurance?

How does insurance work when its not your fault?

Does a no fault accident affect no claims?

What you must pay before an insurance company will pay a claim?

What is an NF form?

Can you claim even if it was your fault?

What is the disadvantage of no fault insurance?

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is nf4 form?

The NF4 form is a form used to declare the non-resident status of an individual for Canadian tax purposes. It is used to declare that the individual is not a resident of Canada for income tax purposes. The form is used by non-residents to report their income from Canadian sources, such as employment income, rental income, business income, or capital gains.

What is the penalty for the late filing of nf4 form?

The penalty for filing a late NF4 form is a $25 late filing fee.

Who is required to file nf4 form?

The NF4 form, also known as the National Form 4, is a tax document that is used by the Internal Revenue Service (IRS) in the United States.

Generally, it is used to report income tax withholdings, such as federal income tax withheld from wages or pensions. It is typically filed by employers or payers who have withheld taxes on behalf of their employees or payees.

Employees or recipients of income who have had taxes withheld may also receive copies of the NF4 form for their own records, but they are not required to file the form themselves. The filing responsibility primarily falls on the employers or payers.

What is the purpose of nf4 form?

The specific purpose of the NF4 form may vary depending on the context it is used in. However, in the United States, the NF-4 form is typically related to income tax reporting. It is used to report income or gains that are not subject to regular withholding tax, such as self-employment income, farming income, rental income, certain gambling winnings, and other miscellaneous income. The form helps individuals or businesses report their taxable income accurately and calculate the amount of tax they owe.

What information must be reported on nf4 form?

The NF4 form, also known as the Employment Insurance and Social Insurance Number Record of Employment form, is used by employers to report employee earnings and insurable hours to Service Canada. The information that must be reported on the NF4 form includes:

1. Employee Information: This includes the employee's name, address, social insurance number (SIN), date of birth, start date of employment, and end date of employment (if applicable).

2. Employment Information: This includes the type of employment (full-time, part-time, temporary, etc.), the employee's occupation, the address of the employer, and the employer's business number (BN) or payroll account number.

3. Earnings: The NF4 form requires reporting of the employee's insurable earnings for each pay period, including regular wages, overtime pay, commissions, bonuses, and any other taxable benefits or allowances received by the employee.

4. Insurable Hours: If applicable, the NF4 form must also include the number of insurable hours worked by the employee during each pay period.

5. Reason for Issuing: The employer must indicate the reason for issuing the Record of Employment (ROE) form, which could be due to termination, temporary layoff, end of contract, or any other reason for which the employee is no longer employed.

6. Signature and Date: The employer or authorized representative must sign and date the NF4 form to certify the accuracy of the information provided.

It is important for employers to accurately report this information on the NF4 form as it is used by Service Canada to determine an employee's eligibility for Employment Insurance (EI) benefits.

How can I edit nf4 from Google Drive?

pdfFiller and Google Docs can be used together to make your documents easier to work with and to make fillable forms right in your Google Drive. The integration will let you make, change, and sign documents, like nys form nf 4, without leaving Google Drive. Add pdfFiller's features to Google Drive, and you'll be able to do more with your paperwork on any internet-connected device.

How do I edit nf4 form online?

pdfFiller not only allows you to edit the content of your files but fully rearrange them by changing the number and sequence of pages. Upload your nf 3 form to the editor and make any required adjustments in a couple of clicks. The editor enables you to blackout, type, and erase text in PDFs, add images, sticky notes and text boxes, and much more.

Can I create an electronic signature for the nys form nf 3 in Chrome?

You can. With pdfFiller, you get a strong e-signature solution built right into your Chrome browser. Using our addon, you may produce a legally enforceable eSignature by typing, sketching, or photographing it. Choose your preferred method and eSign in minutes.

Fill out your nf4 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

nf4 Form is not the form you're looking for?Search for another form here.

Keywords relevant to verification of treatment form

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.